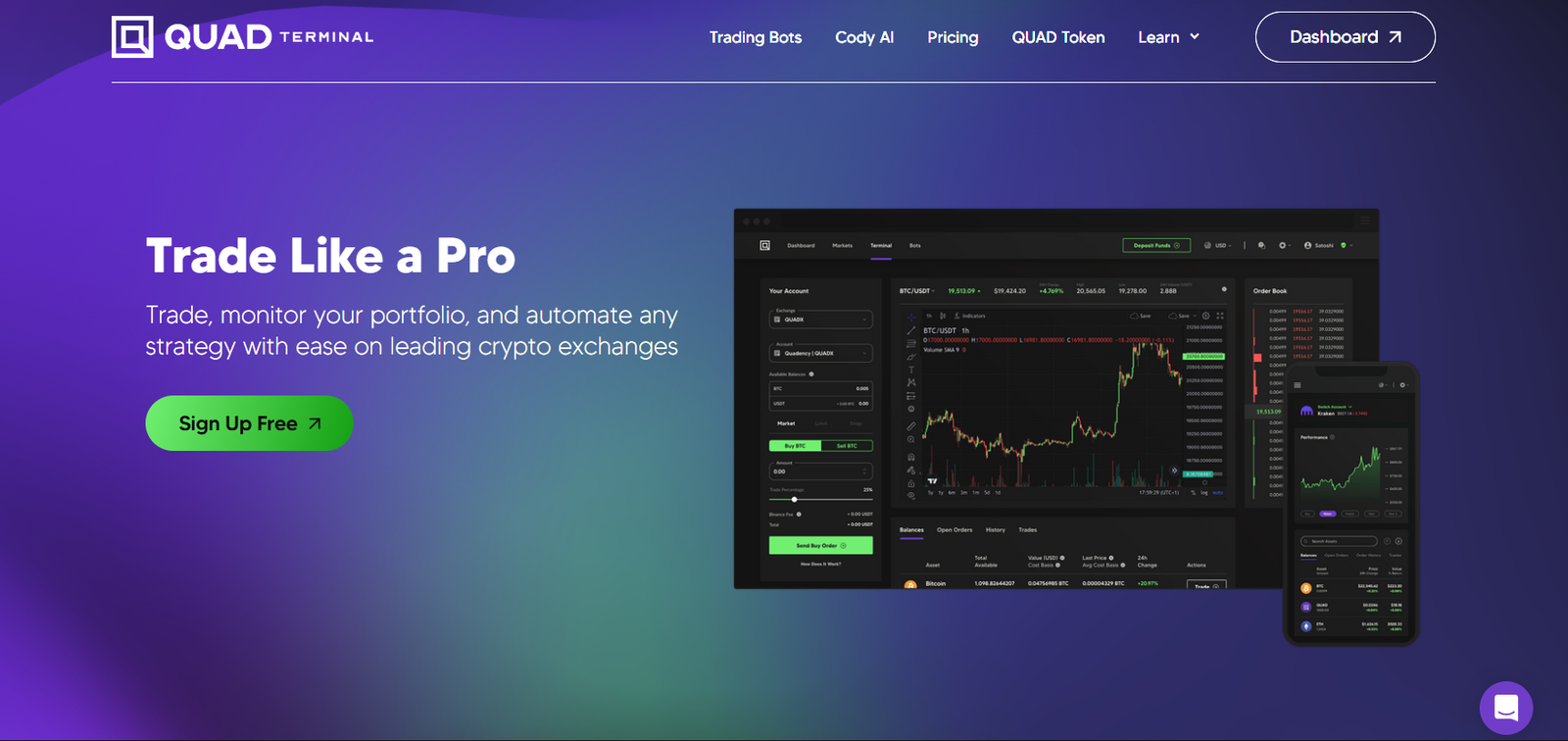

Quad Terminal is an all-in-one AI-powered trading platform designed for professional crypto traders and institutions. It combines powerful charting tools, real-time market data, AI-enhanced analytics, multi-exchange execution, and integrated news feeds into a single, unified dashboard.

The goal of Quad Terminal is to streamline every aspect of cryptocurrency trading—from research and strategy to execution and portfolio management—eliminating the need to switch between multiple platforms, tools, and data sources. Built with institutional-grade infrastructure, the platform is ideal for traders who demand speed, precision, and a comprehensive trading environment.

Features

Unified Multi-Exchange Trading: Trade on multiple exchanges from a single interface with unified order books.

AI-Powered Analytics: Get real-time trading insights, trend detection, and smart alerts powered by machine learning.

Advanced Charting Suite: Access technical indicators, drawing tools, multi-timeframe analysis, and custom layouts.

Real-Time Market Data: Live order books, aggregated liquidity views, and instant price feeds.

Integrated News Feed: Curated crypto and macro news sources with sentiment tagging and event filtering.

Portfolio Tracking: Monitor performance across wallets and exchanges with automatic syncing.

Risk Management Tools: Set stop-loss, take-profit, and portfolio exposure alerts.

Low-Latency Execution: Built on institutional-grade architecture for fast, reliable order execution.

How It Works

Create an Account: Sign up on quadterminal.com to get access to the dashboard.

Connect Your Exchanges: Use API keys to connect Binance, Coinbase Pro, Kraken, or other supported platforms.

Customize Your Workspace: Add widgets for charts, news, trade tickets, order books, and portfolio views.

Analyze and Trade: Use AI-driven insights and advanced charting to place trades directly from the interface.

Monitor Performance: Track your trade history, P&L, and portfolio distribution in real time.

Everything from research to execution happens in one unified terminal, reducing context switching and execution delay.

Use Cases

Day Traders: Execute fast-paced trades with real-time data and low-latency order routing.

Swing Traders: Use AI trend detection and alerts to catch mid-term market movements.

Institutional Investors: Manage large portfolios across multiple exchanges with unified reporting and analytics.

Quant Traders: Feed structured data into external systems via APIs for automation.

Crypto Funds and Desks: Centralize trading activity and improve operational efficiency.

Pricing

Quad Terminal offers flexible pricing tiers based on usage volume and access needs:

Free Plan

Limited charting and analytics

Basic exchange integration

Ideal for casual traders and evaluation

Pro Plan – From $49/month

Full access to AI analytics

Unlimited exchange connections

Custom alerts and risk management tools

Suitable for active retail traders

Institutional Plan – Custom Pricing

Priority execution and data feeds

Dedicated account manager

SLA-backed uptime

API integrations and white-label options

Best for funds, trading firms, and institutions

Free trials and demos are available upon request.

Strengths

Combines research, trading, and portfolio management into one interface

Supports multiple exchanges and trading types (spot, derivatives)

AI tools improve decision-making with real-time alerts and data overlays

Secure and compliant infrastructure with institutional support

Saves time and reduces error compared to managing multiple platforms

Drawbacks

Best suited for advanced users; may overwhelm beginners

No mobile app yet—optimized for desktop traders

API setup required for exchange integrations

Currently crypto-focused—no support for traditional financial markets

Comparison with Other Tools

Quad Terminal vs TradingView

TradingView is great for charting and community features. Quad Terminal adds AI signals, portfolio tracking, and multi-exchange execution in one platform.

Quad Terminal vs Coinigy

Coinigy offers multi-exchange trading, but Quad Terminal enhances this with AI insights, risk management, and a more modern UX.

Quad Terminal vs Bloomberg Terminal (Crypto)

Bloomberg provides institutional data, but Quad Terminal is crypto-native, more agile, and cost-effective for digital asset traders.

Customer Reviews and Testimonials

Users from institutional desks and crypto trading communities have shared strong feedback:

“Quad Terminal is the only platform where I can manage trades, analytics, and news without switching tabs.”

“The AI alerts have helped me avoid costly mistakes and spot new setups early.”

“It’s Bloomberg for crypto, but built by and for traders who actually understand digital assets.”

These testimonials highlight the platform’s value in speed, functionality, and intelligence.

Conclusion

Quad Terminal is redefining how professional traders engage with the crypto markets. By merging powerful charting tools, real-time news, AI analytics, and multi-exchange execution into a single interface, it removes the friction from every stage of trading.

For institutional and high-volume traders looking for an edge in a fast-moving market, Quad Terminal offers a unified, AI-enhanced trading environment that’s hard to beat.