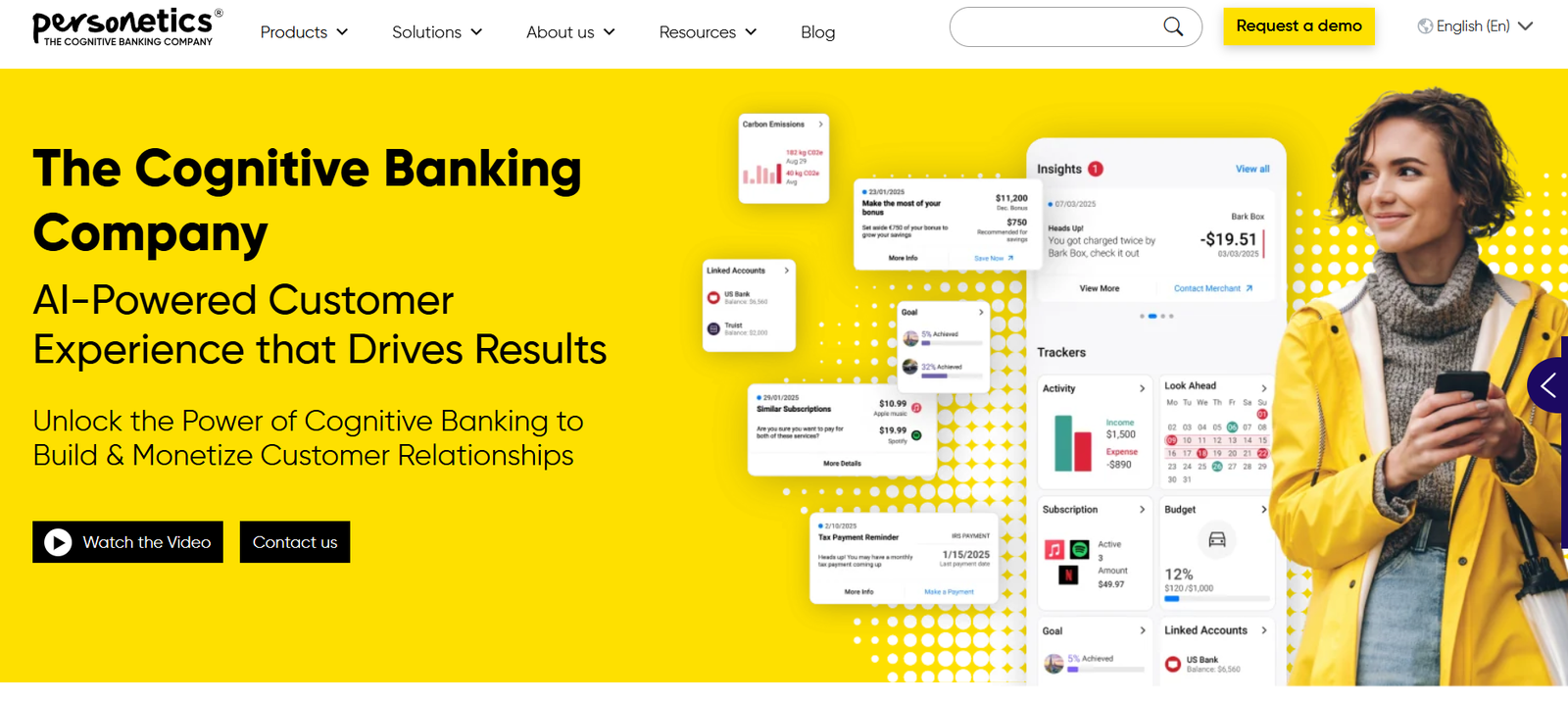

Personetics is an AI-powered personalization and customer engagement platform built specifically for banks and financial institutions. The platform enables financial organizations to deliver proactive, data-driven experiences by analyzing user behavior, transaction data, and financial goals to provide timely insights, recommendations, and actions.

Founded with the mission to transform digital banking into a hyper-personalized experience, Personetics empowers banks to deepen customer relationships, boost engagement, and drive better financial outcomes for users. By offering white-label, real-time financial wellness tools and intelligent automation, Personetics enables banks to become trusted financial advisors, not just service providers.

Features of Personetics

Hyper-Personalized Insights

Personetics uses AI to analyze customer transactions and deliver real-time, personalized insights. These include alerts on spending trends, saving opportunities, and financial habits.

Automated Financial Wellness Programs

The platform enables banks to launch proactive money management programs, such as savings goals, debt reduction plans, and budgeting tools, all tailored to individual user behavior.

Data Enrichment and Categorization

Personetics automatically categorizes financial transactions to provide clearer visibility into spending habits, income patterns, and financial trends.

Behavioral Segmentation

Banks can segment users based on financial behavior, allowing them to deliver targeted campaigns, product offers, and nudges to specific customer groups.

AI-Powered Chat and Conversational UI

Personetics supports intelligent customer service via chat interfaces, enabling users to ask questions about their finances and receive contextual answers instantly.

White-Label and API-First Design

The platform is fully customizable and built to integrate easily into existing digital banking apps via APIs and SDKs, maintaining brand consistency.

Self-Driven Engagement Builder

Banks can use a no-code engagement builder to design, test, and deploy personalized content, financial nudges, and campaigns.

Security and Compliance

The platform complies with major data protection standards, including GDPR and PSD2. It uses bank-grade security to ensure the safe handling of sensitive financial data.

How Personetics Works

Personetics is typically deployed by a bank or financial institution and embedded into its digital banking interface. After integration, the platform begins by ingesting and analyzing transaction data in real-time, either through direct APIs or data feeds.

Once data is received, Personetics enriches it using proprietary AI models—categorizing transactions, identifying income, expenses, subscriptions, and spending anomalies. Based on these insights, it generates personalized messages, alerts, and recommendations, which are delivered to end users within the banking app.

The bank retains full control over branding and messaging. Financial institutions can customize which insights to deploy, build user journeys using the no-code editor, and monitor impact through analytics dashboards.

Personetics also supports closed-loop engagement by allowing customers to take immediate action—such as setting a savings rule or applying for a product—directly from the personalized insight, increasing user participation and satisfaction.

Use Cases of Personetics

Retail Banking

Deliver personalized insights and nudges to help individual customers save, budget, and understand their spending habits.

SME and Business Banking

Offer business clients financial forecasts, cash flow insights, and tailored financial management tips based on transaction data.

Digital-Only Banks

Neobanks and challenger banks use Personetics to differentiate their offerings through intelligent customer engagement and real-time financial guidance.

Wealth Management

Support investors and wealth clients with personalized alerts, market updates, and portfolio monitoring in a conversational format.

Credit Unions and Regional Banks

Smaller institutions can offer big-bank-level personalization by embedding Personetics into their mobile and online banking platforms.

Pricing of Personetics

Personetics does not list public pricing on its official website. The platform follows a custom enterprise pricing model that varies based on:

Type and size of institution

Number of end users

Product modules selected (e.g., insights, savings automation, engagement tools)

Level of customization and integration required

Geographic deployment scope

Banks and financial institutions interested in using Personetics can request a personalized demo and pricing proposal directly via the contact form on the company’s website.

Strengths of Personetics

Banking-Specific AI Platform

Personetics is purpose-built for the financial services industry, offering deep vertical knowledge and tailored capabilities.

End-to-End Personalization

From data analysis to action-oriented insights, Personetics delivers a full engagement loop within banking platforms.

Flexible Deployment

Can be embedded in mobile apps, web portals, or third-party channels using APIs and SDKs.

Proven Track Record

Used by over 100 financial institutions globally, including major banks across North America, Europe, and Asia.

Actionable Intelligence

Goes beyond passive alerts—users can take financial actions like transferring money, setting savings goals, or budgeting directly from the insight.

Regulatory Compliance

Meets strict financial and data protection standards, making it suitable for highly regulated environments.

Drawbacks of Personetics

Enterprise-Only Focus

Personetics is geared toward large financial institutions and may not be accessible to smaller startups or individual developers.

Lack of Public Pricing

The absence of transparent pricing can make early budgeting and evaluation more difficult for prospective clients.

Complex Integration

While well-documented, integration into legacy banking systems may require time and coordination between multiple departments.

Dependent on Data Quality

The effectiveness of insights depends on the quality and granularity of transactional data provided by the bank.

Comparison with Other Tools

When compared to other financial AI tools like Tink, Plaid, or Meniga, Personetics stands out with its end-to-end customer engagement focus. While Plaid and Tink provide data aggregation and categorization, Personetics goes further by offering behavioral insights, financial automation, and engagement-building tools.

Meniga also targets personalized banking experiences, but Personetics offers a more extensive set of white-label engagement tools, including an AI-powered action layer. Unlike general-purpose AI tools, Personetics is highly specialized in the financial domain, with a strong emphasis on real-time user interaction and behavioral personalization.

Customer Reviews and Testimonials

Personetics has partnered with leading banks such as Santander, UOB, and RBC, many of whom have shared public testimonials. Key highlights from client feedback include:

Increased customer engagement and app usage

Enhanced financial wellness scores among users

Reduced churn and improved retention through proactive, helpful financial insights

Faster go-to-market with no-code engagement builder

Positive feedback from users who feel more financially empowered

While individual reviews from end users are rare due to Personetics being a white-label platform, banks report strong ROI and increased user satisfaction after deploying the platform.

Conclusion

Personetics is a powerful and specialized AI solution that transforms how banks interact with their customers. By delivering real-time, personalized financial insights, automating money management, and offering easy-to-integrate tools, Personetics enables financial institutions to become proactive advisors rather than reactive service providers.

Its enterprise-grade architecture, API-first design, and proven success across global banks make it an ideal solution for institutions seeking to improve customer engagement, financial wellness, and digital transformation. Although it’s not aimed at smaller companies or individual users, for banks and large fintechs, Personetics offers a highly impactful way to deepen customer relationships through intelligent, actionable banking experiences.