Sust Global is a climate data and analytics company that provides geospatial intelligence to help organizations understand, quantify, and manage climate-related risks. Combining satellite imagery, climate models, and artificial intelligence (AI), Sust Global delivers location-specific insights into physical climate risks, emissions exposure, and climate resilience strategies.

The platform is designed for enterprises, insurers, asset managers, and supply chain operators looking to meet sustainability goals, comply with climate disclosure regulations (such as TCFD and CSRD), and enhance their climate risk management processes. By translating complex climate data into clear, actionable metrics, Sust Global enables organizations to make informed decisions in the face of accelerating climate challenges.

Features:

Geospatial Climate Risk Intelligence

Sust Global maps physical climate risks—such as heat stress, flood, wildfire, and drought—at the asset or portfolio level using satellite data and climate projections.Climate Scenario Modeling

Analyze future climate impacts across different Representative Concentration Pathways (RCPs) and timeframes, aligned with IPCC scenarios.Asset-Level Risk Scoring

Provides granular climate risk scores for individual assets, properties, or infrastructure projects, enabling precise risk evaluation and planning.TCFD and CSRD Reporting Support

Helps organizations comply with climate-related financial disclosure frameworks by providing transparent, auditable data and analytics.Emissions Data and Transition Risk Insights

Tracks emissions exposure and models climate transition risks, supporting decarbonization strategies and investment screening.API and Platform Access

Offers an enterprise-grade API for embedding Sust Global’s data into existing platforms, dashboards, or reporting systems.Supply Chain Resilience Mapping

Maps supply chain exposure to climate risks, helping businesses identify vulnerable nodes and build resilient sourcing strategies.Portfolio Aggregation and Analytics

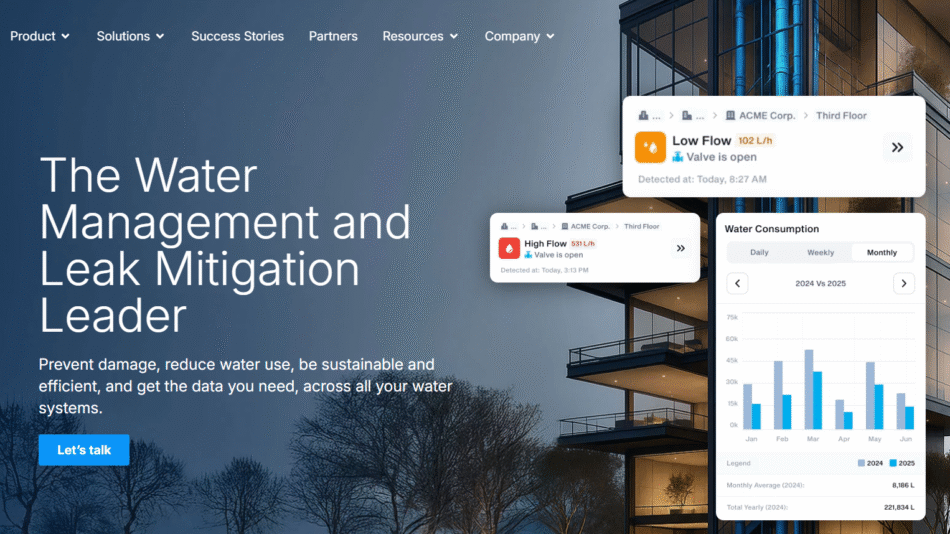

Supports financial institutions with tools to analyze climate risks across entire investment portfolios.Visualization and Decision Support Tools

Generates interactive maps, dashboards, and reports that convert complex datasets into user-friendly visuals.

How It Works:

Data Collection

Sust Global ingests a wide range of data sources, including satellite imagery, historical weather patterns, emissions databases, and climate model outputs.Geospatial Mapping

Each asset or coordinate is mapped to climate hazard exposure zones, using historical and forward-looking models.AI-Powered Analytics

Machine learning algorithms refine and contextualize data for specific use cases, such as TCFD reporting or portfolio risk screening.Risk Scoring and Scenario Analysis

The platform evaluates physical and transition risks under different climate scenarios, assigning quantitative scores at the asset level.Integration and Reporting

Users access results via Sust Global’s API or web-based platform, and can export data for compliance reporting, investment analysis, or internal planning.Ongoing Monitoring

Sust Global supports regular updates and continuous monitoring to keep risk assessments aligned with the latest climate science.

Use Cases:

Real Estate and Infrastructure Investment

Assess the physical climate risk to properties and infrastructure under future climate scenarios for better valuation and risk planning.Asset Management and Finance

Evaluate climate risks across global investment portfolios to meet regulatory and ESG requirements.Corporate Sustainability and Risk Teams

Track asset-level climate exposure and transition risks, supporting sustainability reporting and net-zero strategies.Supply Chain Management

Identify climate-vulnerable nodes across global supply chains and optimize sourcing decisions.Insurance and Reinsurance

Underwrite property or infrastructure policies based on forward-looking climate risk data and improve catastrophe risk models.Public Sector and NGOs

Support regional planning, climate adaptation strategies, and policy development with transparent geospatial data.

Pricing:

Sust Global does not publish fixed pricing on its website, as solutions are highly customized to client needs and use cases. However, pricing depends on several factors:

Number of Assets or Locations

Pricing typically scales based on how many locations or coordinates require analysis.Data Access Method

API access for integration may involve tiered subscription pricing, while access via platform or dashboards may follow a license model.Use Case Complexity

Detailed scenario modeling, emissions profiling, or supply chain mapping may involve custom analytics or support services.Reporting Needs

Clients requiring custom reporting aligned with frameworks like TCFD, CSRD, or SBTi may incur additional charges.

For a custom quote or demo, businesses can contact Sust Global directly at:

https://www.sustglobal.com/contact

Strengths:

Asset-Level Precision: Provides location-specific risk scores instead of broad regional estimates.

Science-Aligned Modeling: Uses IPCC-aligned climate scenarios and emissions pathways.

API-Friendly: Built for integration with enterprise systems, ESG platforms, and investment tools.

Regulatory Compliance Support: Streamlines reporting for TCFD, CSRD, and other global frameworks.

Cross-Sector Applications: Serves real estate, finance, insurance, supply chains, and more.

Global Coverage: Works with data across all major geographies and climate zones.

Interactive Visualization: Translates data into clear maps and dashboards for decision-makers.

Drawbacks:

No Public Demo or Free Tier: The platform is enterprise-focused and does not offer a trial version for individual users.

Requires Technical Integration for API Use: Companies need technical resources to integrate the API into their platforms.

Not Designed for Farmers or Smallholders: The platform is geared toward enterprise clients, not small-scale agricultural users.

Data Interpretation Expertise Needed: While visual, interpreting climate risk data may require sustainability or ESG expertise.

Pricing Transparency Lacking: Prospective users must contact sales for any pricing information.

Comparison with Other Tools:

Climate Alpha: Focuses on real estate investment and future value predictions. Sust Global offers broader support for regulatory compliance and emissions risk as well.

Jupiter Intelligence: Also provides climate risk modeling for enterprises. Sust Global differentiates itself with API-first infrastructure and portfolio-level emissions exposure analysis.

Cervest: Specializes in climate risk for asset managers. Sust Global offers additional emissions insights and supports a wider variety of sectors.

S&P Global Sustainable1: A major data provider with climate and ESG analytics. Sust Global competes by offering greater flexibility in asset-level analysis and custom modeling.

Customer Reviews and Testimonials:

Sust Global features partnerships and case studies with leading organizations in finance, real estate, and climate analytics, including:

Collaboration with Microsoft: Sust Global participated in Microsoft’s AI for Earth program, leveraging cloud-scale computing for climate modeling.

Partnerships with ESG Data Providers: Sust Global integrates with third-party ESG platforms to streamline reporting and investment analysis.

Use in Supply Chain Risk Assessment: Featured in ESG and climate intelligence forums for its ability to map and mitigate supply chain vulnerabilities.

While the company does not publish individual customer reviews on its website, its presence in climate-focused media and collaborations with corporate clients indicate a high level of trust and adoption.

Conclusion:

Sust Global is a forward-looking climate intelligence platform that equips enterprises with the tools to understand and act on climate risk at scale. Through its combination of geospatial analytics, AI modeling, and regulatory alignment, it transforms complex climate data into clear, actionable insights for decision-makers.

Whether for regulatory reporting, investment risk analysis, or supply chain resilience, Sust Global provides a robust foundation for navigating the rapidly evolving climate risk landscape. Its API-first infrastructure and asset-level analytics make it a flexible and powerful choice for companies pursuing sustainable growth.