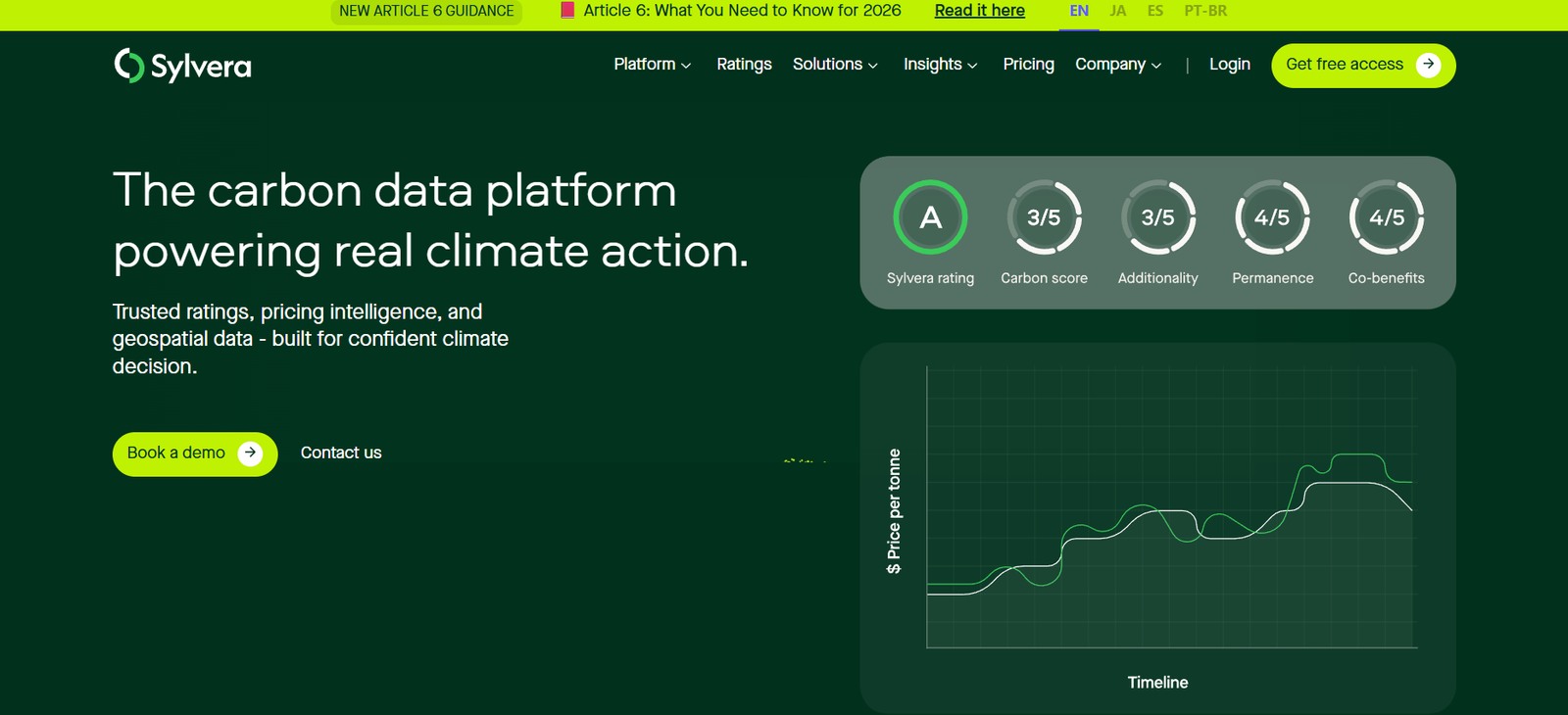

Sylvera is a carbon intelligence platform that provides independent, data-backed ratings of carbon offset projects. By combining satellite data, machine learning, and expert analysis, Sylvera helps businesses and governments make informed decisions about which carbon credits to buy—ensuring they invest only in high-quality, verifiable, and effective climate solutions.

Founded in London, Sylvera was created to address a critical challenge in the voluntary carbon market: lack of transparency and trust. With billions being spent on offsets that may not deliver real environmental benefits, Sylvera aims to bring accountability and clarity to carbon markets by assessing the actual performance of carbon projects—especially nature-based and engineered carbon removal solutions.

Features:

Carbon Credit Ratings

Independent assessments of offset projects using an A-F rating scale to indicate credit quality.Project Transparency

Detailed reports on project effectiveness, permanence, additionality, and risk factors.Satellite Monitoring

Uses high-resolution satellite imagery to track forest cover, biomass, and land-use changes over time.Machine Learning Models

Applies AI to detect discrepancies between reported and observed project outcomes.Comprehensive Project Database

Access to hundreds of carbon offset projects across reforestation, REDD+, and engineered solutions.Portfolio Management Tools

Tools to evaluate, compare, and optimize carbon credit portfolios for compliance or voluntary markets.Regulatory Alignment

Supports carbon procurement in line with global frameworks such as SBTi, ICVCM, and TCFD.ESG & Net-Zero Support

Helps companies assess how carbon credits align with corporate sustainability and net-zero strategies.API Integration

Seamless integration of Sylvera ratings into procurement systems, ESG dashboards, and sustainability platforms.

How It Works:

Project Assessment

Sylvera collects satellite imagery, project documentation, and third-party reports to analyze carbon project performance.Data Analysis

Machine learning models compare observed carbon sequestration or avoided emissions with claimed impact.Expert Review

Scientific and policy experts validate AI findings and apply a proprietary scoring framework.Rating Assignment

Each project is assigned a rating (A to F) based on additionality, permanence, leakage risk, and co-benefits.Client Access

Companies use the Sylvera platform to assess potential purchases and monitor existing credits.

Use Cases:

Carbon Credit Procurement

Select high-integrity projects to ensure climate investments are credible and effective.Sustainability Teams

Validate carbon offset strategies and ensure alignment with net-zero goals.ESG Reporting

Provide transparent documentation of offset quality for stakeholder reporting and disclosures.Financial Institutions

Evaluate climate impact and risk across offset portfolios and investment strategies.Government & Policy Bodies

Inform regulatory frameworks and offset standards with real-world project data.Carbon Market Platforms

Integrate Sylvera ratings into offset marketplaces to increase buyer trust.

Pricing:

Sylvera offers custom pricing based on client size, platform usage, and access level. Plans typically vary by:

Number of projects rated or analyzed

Size of carbon credit portfolio

API or platform access requirements

Sector-specific needs (e.g., finance, energy, consumer goods)

Strengths:

Independent and Transparent Ratings

Helps eliminate greenwashing and ensures offsets deliver real climate benefits.Science-Driven Methodology

Combines AI, satellite data, and expert analysis for high accuracy.Supports Regulatory Compliance

Aligned with global standards and frameworks like SBTi and VCMI.Customizable and Scalable

Suitable for SMEs to large enterprises across multiple sectors.Improves Market Confidence

Empowers buyers to make trusted, data-backed climate investments.

Drawbacks:

Not a Carbon Credit Seller

Sylvera rates projects but does not facilitate direct transactions.Enterprise-Focused

Not intended for individual consumers or small-scale offset buyers.Requires Carbon Market Familiarity

Best suited for professionals with a baseline understanding of carbon accounting and offsetting.Opaque Pricing Structure

Pricing is custom and not disclosed publicly, which may deter smaller buyers.

Comparison with Other Tools:

BeZero Carbon: Also offers ratings, but Sylvera is often seen as more focused on transparency and regulatory alignment.

Verra & Gold Standard: Issue project certifications, while Sylvera evaluates whether those certified projects truly deliver.

Pachama: Focuses on forest projects and offset sales; Sylvera is platform-neutral and strictly assessment-based.

Cloverly & Patch: Marketplaces that can integrate Sylvera ratings for quality assurance.

Customer Reviews and Testimonials:

Sylvera is trusted by leading companies in climate-conscious sectors, including:

Santander

Cervest

Climate Impact X

Enterprise-level ESG teams across the EU and US

Endorsements include:

“Sylvera gives us confidence that we’re investing in the right carbon credits.”

“Their platform helps us vet our offset portfolio and avoid greenwashing.”

“Finally, a reliable way to compare carbon credits based on real-world performance.”

Sylvera has been featured in Bloomberg, Financial Times, TechCrunch, and the World Economic Forum as a pioneer in building trust in voluntary carbon markets.

Conclusion:

Sylvera is solving one of the biggest challenges in climate action: ensuring that carbon offsets are real, reliable, and effective. By offering trusted, data-backed ratings and detailed project insights, Sylvera enables businesses to invest in carbon credits with confidence—and avoid the reputational and environmental risks of low-quality offsets.

For companies aiming to reach net-zero targets while demonstrating transparency and accountability, Sylvera is an essential tool for building and managing a credible carbon strategy.