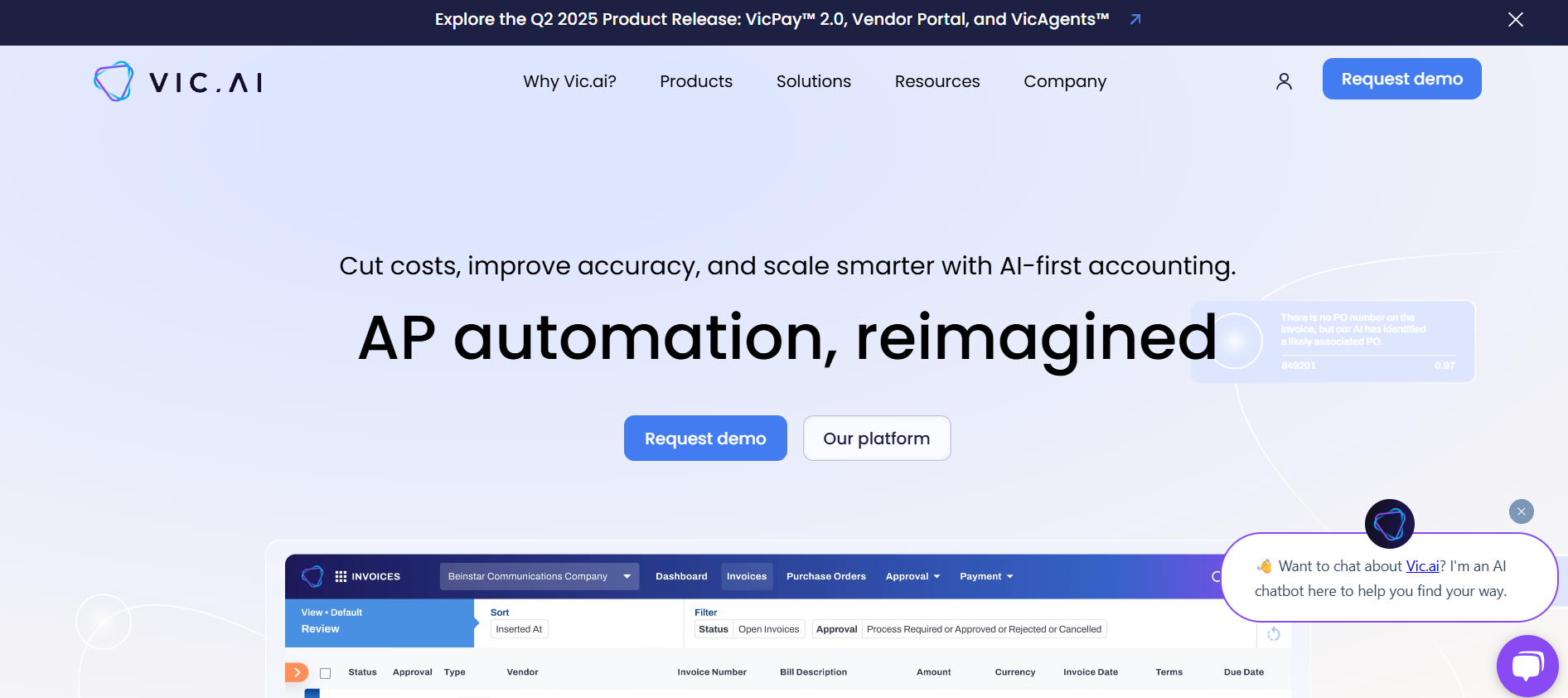

Vic.ai is an artificial intelligence platform that automates core accounting tasks such as invoice processing, approval workflows, and cost allocations. Built specifically for finance teams, Vic.ai applies advanced machine learning and artificial intelligence to deliver greater efficiency, accuracy, and control in back-office operations.

Unlike traditional robotic process automation (RPA), Vic.ai learns from historical data and adapts to company-specific workflows. It processes financial documents autonomously, handles complex accounting decisions, and provides real-time analytics—helping CFOs, controllers, and AP departments close books faster and with fewer errors.

Features

Vic.ai offers enterprise-grade capabilities that streamline finance operations:

Autonomous Invoice Processing

Automatically extracts, interprets, and posts invoice data with minimal human input.Approval Workflow Automation

Routes invoices to the correct approvers, manages multi-tier approvals, and tracks timelines.Intelligent Cost Allocation

Allocates expenses to the right cost centers or general ledger accounts using AI-trained patterns.Confidence Scoring

Assigns confidence levels to each prediction, allowing teams to review only exceptions or low-certainty outputs.Audit Trail and Transparency

Every AI decision is tracked, recorded, and auditable, supporting compliance and reporting.Integrations with ERP Systems

Seamlessly connects to platforms like Sage Intacct, Oracle NetSuite, Microsoft Dynamics, and others.Performance Insights and Benchmarking

Real-time dashboards track processing speed, accuracy, and performance trends.Learning from User Feedback

AI models continuously improve as users correct or validate predictions.Multi-Currency and Multi-Entity Support

Built for global finance teams managing different regions or subsidiaries.

How It Works

Vic.ai combines automation with AI intelligence to transform traditional accounting:

Invoice Ingestion

Invoices are uploaded or sent to the system via email or ERP integration.AI Data Extraction and Interpretation

The platform reads invoice details (e.g., vendor name, line items, totals) and understands context like cost centers or departments.Decisioning and Coding

Based on historical data and learned behavior, Vic.ai auto-codes transactions with account numbers and business rules.Confidence Scoring and Review

Outputs are ranked by confidence level. High-confidence invoices can be auto-posted, while others are flagged for review.Approval Workflow Execution

Approved invoices follow the preset workflow, triggering notifications and escalating when needed.ERP Integration and Posting

Once validated, invoices are posted directly into the company’s ERP or accounting system.

This enables straight-through processing for high-confidence tasks and targeted human review where necessary.

Use Cases

Vic.ai is tailored for medium to large enterprises seeking intelligent automation in accounting and finance:

Accounts Payable Automation

Eliminate manual entry, speed up invoice approval, and improve accuracy.Month-End Close Acceleration

Reduce closing time with AI-driven classification and error detection.Expense Coding and GL Matching

Automatically assign correct general ledger codes and cost centers.Audit and Compliance Readiness

Maintain a full history of invoice processing decisions and exceptions.Vendor Management

Gain insights into payment cycles, errors, and discrepancies across suppliers.Multi-Entity Finance Operations

Streamline shared services or group-level finance processes across different locations and entities.

Pricing

Vic.ai does not publicly list its pricing on the website as of June 2025. Pricing typically depends on:

Number of invoices processed per month

Size of the finance team or number of users

Required integrations and ERP systems

Multi-entity or international complexity

Support and onboarding services

Organizations interested in Vic.ai can schedule a demo and receive a custom quote by contacting their sales team directly at https://www.vic.ai.

Strengths

Vic.ai delivers several notable advantages for finance teams:

True AI Decisioning

Goes beyond rules-based automation by applying machine learning to improve over time.Exceptional Accuracy

Learns from user corrections and delivers high accuracy in data extraction and cost coding.Reduced Manual Workload

Frees up finance teams from repetitive invoice entry and verification tasks.Compliance and Transparency

Audit-ready processing with full documentation of all AI decisions.Seamless ERP Integration

Connects easily with widely-used financial systems and APIs.Scalable Across Teams and Regions

Supports multiple entities, currencies, and approval workflows.

Drawbacks

While powerful, Vic.ai has some limitations and considerations:

No Self-Serve Access

Currently designed for mid-to-large enterprises, not available for individuals or small businesses.Custom Pricing Required

Lack of transparent pricing or trial access could slow initial adoption for budget-sensitive teams.Focused on Accounts Payable

While highly specialized in AP, broader finance automation (e.g., AR, payroll) is less emphasized.Initial Setup and Integration

Some setup effort is required to configure workflows and ERP connectivity.AI Accuracy Depends on History

Performance improves with data. New companies or teams without sufficient history may see slower benefits.

Comparison with Other Tools

Vic.ai vs. Bill.com

Bill.com is a user-friendly AP automation tool for SMBs. Vic.ai offers more advanced AI-powered decisioning for enterprises.

Vic.ai vs. Airbase or Ramp

These are spend management platforms. Vic.ai focuses specifically on AP and accounting intelligence, not card issuing or budgeting.

Vic.ai vs. UIPath or Automation Anywhere

Those are general RPA platforms. Vic.ai is built specifically for finance, with tailored AI models for accounting logic.

Vic.ai vs. Tipalti

Tipalti handles global payables and supplier onboarding. Vic.ai automates the AP lifecycle with smarter decisioning and document AI.

Customer Reviews and Testimonials

Vic.ai is trusted by finance teams at companies like HSB, PwC, and HireQuest. Reviews highlight meaningful productivity improvements:

“Vic.ai cut our invoice processing time by over 60%.”

“The AI is remarkably accurate. We’ve reduced errors while processing more invoices.”

“Our AP team now focuses on exceptions, not data entry.”

According to customer stories on the Vic.ai site, clients report faster month-end close cycles, better compliance, and improved employee satisfaction in finance departments.

Conclusion

Vic.ai brings a new era of intelligent automation to accounting—one that combines data extraction, classification, and decision-making using AI. For finance teams processing high volumes of invoices or looking to scale operations without growing headcount, Vic.ai offers a compelling solution that’s smarter, faster, and more accurate than traditional methods.

With seamless ERP integrations, explainable AI decisions, and support for multi-entity workflows, Vic.ai is a strategic asset for CFOs and controllers modernizing finance operations.