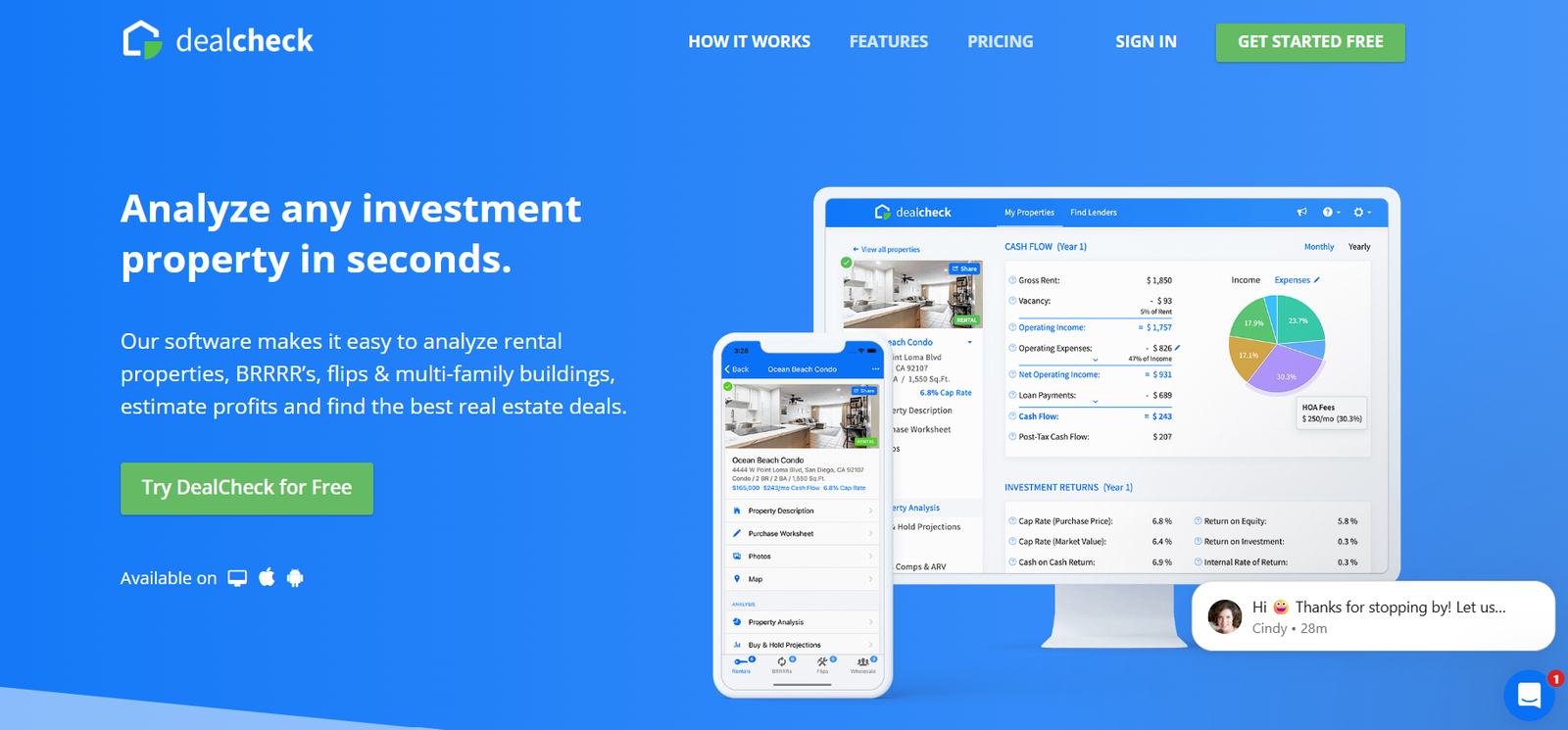

DealCheck is a cloud-based real estate analysis tool designed to help investors, agents, and property managers evaluate rental properties, flips, multifamily buildings, and BRRRR deals quickly and accurately. Used by over 200,000 investors globally, DealCheck simplifies the process of calculating returns, estimating cash flow, and comparing deals across markets. Whether you’re analyzing single-family rentals or complex multifamily acquisitions, DealCheck streamlines the process with automated data imports, customizable metrics, and professional-grade reports.

Its user-friendly platform makes it accessible to both beginners and seasoned investors, offering valuable insights without the need for spreadsheets or complex calculators. Accessible via web and mobile apps, DealCheck is a portable solution for real estate decision-making.

Official website: https://dealcheck.io

Features

Property Analysis Tools: Analyze rentals, flips, BRRRRs, multifamily, and commercial properties with detailed financial projections.

Customizable Calculation Settings: Adjust assumptions like vacancy rate, repair costs, financing terms, and more to match your strategy.

Automated Property Data Import: Pull property data from public records or MLS with just an address entry.

Sales & Rental Comps: View recent sales and rental comps to estimate ARV (After Repair Value) and rental income.

ROI and Cash Flow Projections: Instantly calculate metrics such as cap rate, cash-on-cash return, IRR, and break-even points.

Professional Reports: Export or share custom-branded PDF reports for clients, partners, or lenders.

Deal Comparison Tools: Compare multiple properties side-by-side based on key financial indicators.

Portfolio Tracking: Keep track of all your past and current investments in one place.

Mobile App Support: Fully functional apps for iOS and Android for deal analysis on the go.

Property Photos and Notes: Store visual and textual information for better documentation and presentation.

How It Works

Input a Property Address: Start by entering a property’s address or import it using MLS/public records.

Select Investment Strategy: Choose the type of investment—rental, flip, BRRRR, or multifamily.

Adjust Assumptions: Customize purchase details, rehab costs, financing terms, income, and expenses.

View Instant Analysis: DealCheck calculates over 20 key metrics including cash flow, ROI, cap rate, and profit projections.

Compare and Share: Save the analysis, compare it with other deals, or export it as a report.

The platform uses preset templates for each property type, which you can tailor to fit your investing model. This allows rapid analysis and standardized deal comparisons across markets and property types.

Use Cases

Individual Real Estate Investors: Quickly evaluate rental properties or flips before making an offer.

Real Estate Agents: Share professional property analysis reports with clients to support decision-making.

Wholesalers: Analyze properties to present compelling deals to buyers.

Lenders and Partners: Provide financial breakdowns and projections to stakeholders.

Portfolio Managers: Monitor performance and track multiple investment properties over time.

New Investors: Learn how to evaluate deals with guided templates and built-in examples.

Pricing

DealCheck offers a tiered pricing structure:

1. Free Plan

Analyze up to 15 properties

Basic property analysis

Limited comparables

Limited report features

2. Plus Plan – $10/month or $99/year

Up to 50 saved properties

Full access to comps

Customizable analysis

Branded PDF reports

Enhanced features for small-scale investors

3. Pro Plan – $20/month or $199/year

Unlimited properties

Full access to all features

Advanced calculation options

Portfolio tracking

Priority support

Ideal for professional investors and agents

You can view current pricing and compare plans at the official pricing page: https://dealcheck.io/pricing

Strengths

Ease of Use: Intuitive interface suitable for beginners and experts alike.

Comprehensive Analysis: Offers detailed financial metrics with adjustable assumptions.

Mobile Accessibility: Analyze deals from anywhere with native mobile apps.

Time-Saving: Automated data import and one-click financial projections save hours of manual work.

Custom Branding: Useful for agents and professionals needing client-ready reports.

Versatility: Supports a wide range of investment strategies and property types.

Drawbacks

Free Plan Limitations: The free version restricts access to key features like comps and advanced metrics.

U.S.-Centric: Primarily supports U.S. properties; limited functionality for international investors.

No Team Collaboration Features: Does not offer dedicated multi-user team workflows or shared dashboards.

Learning Curve for Customization: While basic use is easy, mastering advanced settings may take time.

Comparison with Other Tools

DealCheck vs. BiggerPockets Calculator

BiggerPockets offers analysis tools as part of a broader community platform.

DealCheck is more focused, with a cleaner interface and mobile-first experience.

DealCheck provides more customizable settings and better PDF report options.

DealCheck vs. PropStream

PropStream is more comprehensive in data mining and lead generation.

DealCheck focuses purely on deal analysis and financial forecasting.

For users who want analysis without sales data overload, DealCheck is simpler and more affordable.

DealCheck vs. REI/Analyst

REI/Analyst targets commercial real estate and institutional investors.

DealCheck is ideal for residential investors, flippers, and small portfolios.

DealCheck is also more budget-friendly and user-friendly.

Customer Reviews and Testimonials

DealCheck has received strong feedback across real estate communities and platforms like Product Hunt and the App Store. Highlights from user reviews:

“I can run numbers in 5 minutes instead of spending hours in Excel.” – Independent Investor

“DealCheck is now part of my daily workflow as a real estate agent.” – Licensed Realtor

“Highly intuitive and saves so much time. Great for quick screening of properties.” – BRRRR Investor

“The Pro version is worth every penny if you do multiple deals.” – Real Estate Wholesaler

On the App Store and Google Play, DealCheck maintains high ratings (4.8+), reflecting its quality and reliability.

Conclusion

DealCheck is an essential tool for real estate investors, agents, and professionals seeking efficient and accurate property analysis. With its robust features, clean interface, and affordable pricing, DealCheck is ideal for evaluating rentals, flips, BRRRRs, and multifamily investments. While it’s primarily U.S.-focused and lacks collaboration tools, its strengths in automated data import, ROI forecasting, and professional reporting make it a top choice for solo investors and real estate professionals alike.

For those serious about making informed investment decisions without relying on spreadsheets, DealCheck offers a scalable solution that grows with your portfolio.