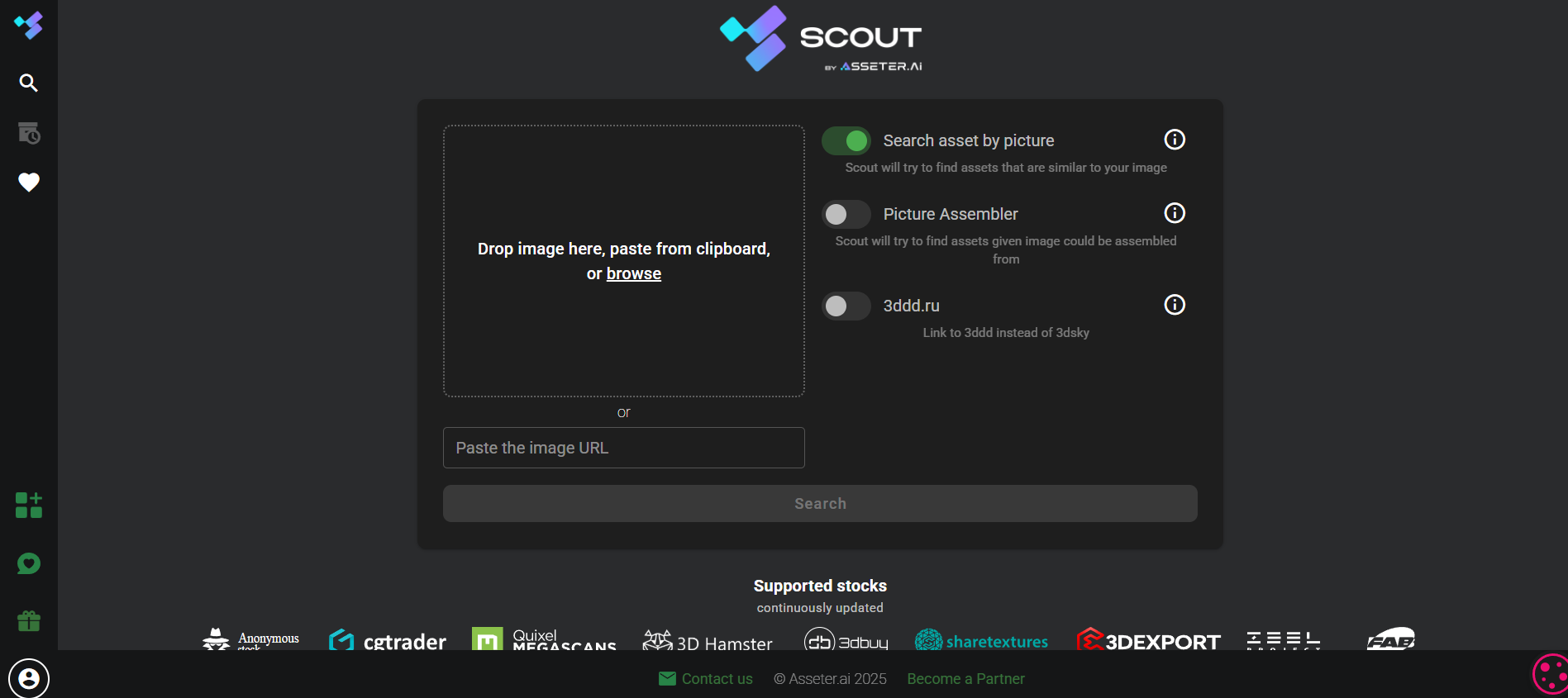

Asseter Scout is a modern, AI-powered deal sourcing and startup intelligence platform that enables venture capital, private equity, and corporate investment teams to automate and optimize how they discover, evaluate, and track early-stage companies.

In an increasingly competitive investment landscape, sourcing high-potential startups and evaluating them efficiently is a key differentiator. Asseter Scout addresses this need with a data-driven platform that combines AI discovery tools, customizable filters, company profiling, and market trend tracking — all within a single interface.

Built by investment professionals for investment professionals, the platform is ideal for sourcing opportunities at scale, enriching the deal pipeline, and making informed investment decisions faster.

Features

Startup Discovery Engine: Continuously scans thousands of public and private sources to surface promising startups across sectors.

Custom Sourcing Filters: Set custom filters by industry, stage, geography, funding, business model, and more to refine results.

AI Scoring & Matching: Assigns relevance scores to startups based on your investment thesis, portfolio fit, and historic preferences.

Company Profiles: Aggregates detailed startup data — funding rounds, founders, traction metrics, product descriptions, and more.

Team & Technology Insights: Evaluate technical founders, product maturity, and team credentials from one profile.

Market Signals & Trends: Uncover emerging market categories and benchmark startup momentum in real time.

CRM Integration: Syncs with investment CRMs to seamlessly manage sourcing workflows and avoid duplicate diligence.

Automated Tracking: Follow target companies and receive alerts for funding, news, hiring, and market changes.

Competitor Mapping: Compare startups side-by-side or across sectors to identify gaps or overlapping bets.

Collaboration Tools: Share insights with partners and analysts through annotations, notes, and shared dashboards.

How It Works

Define Investment Focus: Set up your firm’s sourcing filters based on sector, deal stage, region, and investment criteria.

Discover Startups: Scout surfaces companies that match your filters, using real-time data and AI pattern recognition.

Review Profiles: Dive into enriched company profiles, including founders, traction, tech stack, funding history, and product insights.

Evaluate with AI Scoring: Use automatic relevance scores and custom tagging to prioritize companies in the pipeline.

Track and Collaborate: Add promising leads to your tracker, assign to team members, and add comments or follow-up actions.

Integrate with CRM: Sync to platforms like Affinity, Salesforce, or DealCloud to streamline tracking and reporting.

Use Cases

Early-Stage VCs: Discover pre-seed and seed startups before they appear on public radars.

Growth Equity & PE Firms: Find later-stage opportunities and expansion-ready startups with validated traction.

Family Offices: Build a customized sourcing engine aligned with niche investment mandates.

Corporate Venture Teams: Identify strategic startups that align with product, R&D, or ecosystem initiatives.

Investment Analysts: Save hours on research by accessing structured, AI-compiled company insights.

Fund Managers: Track pipeline metrics, assign deals internally, and make data-informed investment decisions.

Pricing

As of June 2025, Asseter Scout offers custom pricing tailored to the size and needs of each investment team. Pricing varies based on:

Number of team users

Geographic coverage

Data enrichment level (basic vs. premium profiles)

Integration with CRMs and internal tools

Level of AI customization and scoring logic

Onboarding and dedicated support

To request a demo or personalized quote, visit https://scout.asseter.ai and use the “Request Access” form.

Strengths

Investor-Focused Design: Tailored specifically for venture and private equity sourcing workflows.

AI-Powered Search: Leverages machine learning to match startups to specific investment theses.

Structured Startup Data: Saves analysts and partners time by compiling deep startup profiles in seconds.

Proactive Alerts: Stay up to date with real-time funding updates, product launches, and hiring signals.

Highly Customizable: Adjustable scoring logic and filters let teams create a unique sourcing engine.

Easy Collaboration: Facilitates shared deal tracking, internal notes, and team assignments.

CRM-Friendly: Works well alongside existing investment pipeline systems.

Drawbacks

No Public Free Tier: Currently designed for firms with professional sourcing needs — no free version is listed.

Requires Some Setup: To get the best results, filters and AI matching should be aligned with your firm’s focus.

Best for Tech-Savvy Teams: Works best when integrated into a structured deal flow process.

Limited Reviews Publicly: As of now, few third-party review sites (like G2 or Capterra) have detailed user ratings.

Focus on Tech Startups: May not yet offer full coverage for traditional industries or non-digital business models.

Comparison with Other Tools

vs. Crunchbase Pro: Crunchbase is broad and manual; Asseter Scout is tailored for automated, thesis-driven sourcing.

vs. PitchBook: PitchBook offers deep financial data but lacks the AI-powered discovery and customizable scoring logic of Scout.

vs. Affinity: Affinity is primarily a CRM; Scout complements it with deeper sourcing and profiling tools.

vs. Dealroom: Dealroom is strong in EU coverage. Scout focuses more on personalized deal discovery with custom filters and U.S. + global relevance.

vs. CB Insights: CB Insights tracks trends well; Asseter Scout adds startup-level profiling and AI matching capabilities.

Asseter Scout is ideal for investors who need automated, intelligent, and scalable sourcing in an increasingly noisy and fast-moving venture market.

Customer Reviews and Testimonials

Though public reviews are limited, early users from VC firms and investment analysts have provided encouraging feedback:

“We’ve automated the early part of our deal funnel with Asseter Scout — now we spend more time evaluating, not searching.”

“It’s like having an extra analyst who works 24/7. The quality of discovery and profile depth is impressive.”

“The AI scoring feature helps us prioritize startups that match our fund’s DNA. It’s an essential tool for early-stage sourcing.”

The platform is already being adopted by early-stage funds, accelerators, and corporate VC teams looking to modernize their sourcing stack.

Conclusion

Asseter Scout is a powerful AI platform that redefines how investors source, screen, and track startup deals. By automating research, centralizing insights, and using smart filters and scoring, it transforms deal sourcing from a manual task into a strategic advantage.

For venture capitalists, private equity analysts, and corporate investment teams, Asseter Scout provides the visibility, efficiency, and intelligence needed to stay ahead in the fast-paced world of startup investing.

If your firm is ready to upgrade from spreadsheets and basic search to AI-powered sourcing and startup discovery, Asseter Scout is a tool worth serious consideration.